The total number of U.S. households is projected to increase between 2018 and 2028 by 12.2 million, however the demand is for 15.1 million new housing units in the same period. In order to meet this demand for a growing and diverse population in municipal markets, the U.S. needs to build 4.6 million new apartments and renovate an additional 11.7 million by 2030. This equates to 328,000 new apartment homes every year. That number has only been achieved three times in the past 30 years. A potential huge housing shortage will occur across all income demographics unless capable real estate investment platforms work to address the challenge.

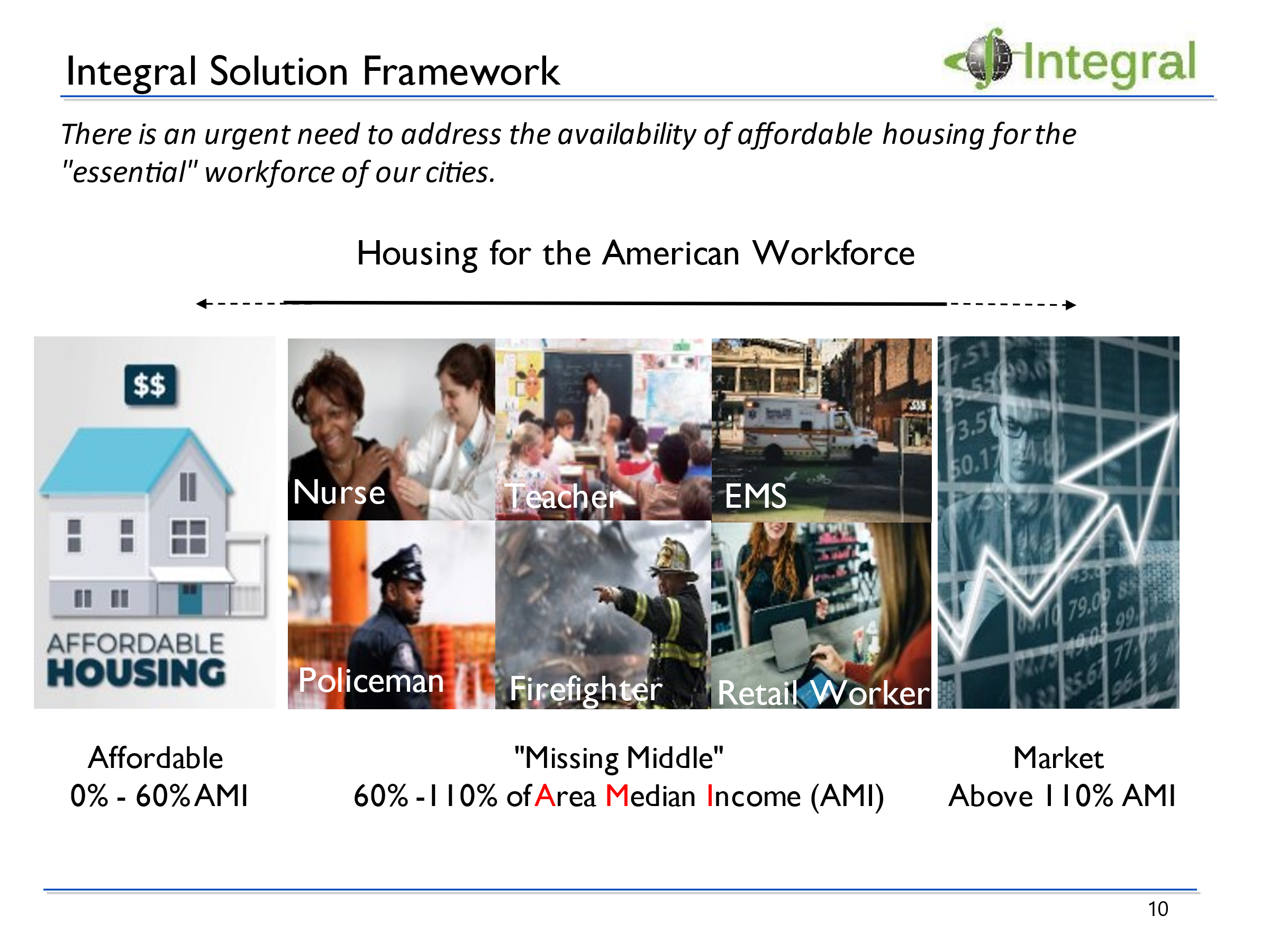

Integral has managed both tax incented and conventional real estate private equity funds for various institutional and private investors, along with the appropriate asset management and fund reporting services. Our focus is on multifamily investment opportunities in what we describe as the “MISSING MIDDLE” consumer segments, the population that earns between 60% and 110% of average median income (AMI).